I threw extra cash at a new S&P low-cost index fund today.I got itchy to make some sort of move today - Sold a bunch of VWEAX and split the proceeds between PDI and BSTZ

so a mutual fund for two closed end funds. Hoping the dividend is stable (although they use a return of capital if needed to maintain it)

Using that as monthly retirement income (1 year until SS kicks in)

Also have some OXLC which throws off quite a bit of money, but I like the size of PIMCO and Blackrock over Oxford Lane.

Wonder if I should put a stop loss on it?

not sure how senior secured debt pays so much vs junk bond portfolios? maybe the default rate?

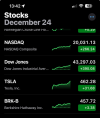

Crash should start tomorrow.